You’re reading Reaction. To get Iain Martin’s weekly newsletter, columnists including Tim Marshall, Maggie Pagano and Adam Boulton, full access to the site and invitations to member-exclusive events, become a member HERE.

If, one hopes, Vladimir Putin does not invade the Ukraine, there are some critical lessons which we can learn from the crisis, which taken together with what needs to be done as we emerge from the pandemic, means sensible people have their work cut out.

The first is that two decades of botched energy policy, compounded by both the Theresa May and Boris Johnson administrations, have not only left the economy exposed to inflation and pushed millions of people into energy poverty, it has left us in a more strategically weakened position than at any time since the Cold War.

In fact, we might argue there is now a new Cold War, given Beijing and Moscow’s mutual support, including the signing of a gas deal during the crisis.

The day has been saved by American Liquefied Natural Gas. Bloomberg reports that it was “exporting every molecule possible to Europe”, with all seven of its terminals docked and loading last weekend for the first time. A record 13.3 billion cubic feet of LNG flowed through US terminals on Saturday. That is about a day and a half’s worth of consumption for Germany.

Partly, this was ordinary market function, as natural gas prices are six times higher in Europe than the Henry Hub price in the US. But partly it was a strategic choice by the Biden administration to pull out all the stops to assist European allies.

Record prices come down

It was the prospect of a great armada of US LNG vessels which brought the forward month price down from a record €166 per MWH at the Dutch Transfer Facility on December 21st, to €80 on Monday, and €76 on Tuesday. That is still four times the underlying level before the crisis.

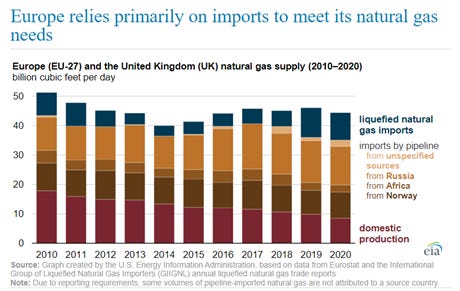

If that had not happened and the price had galloped up further, the European economy, including the British economy, would have been brought to a shuddering halt and we would have sued for any terms possible with Moscow. We are dependent on Russia for natural gas, as the chart from the US Energy Information Administration, shows.

Imports of natural gas by both pipeline and liquefied natural gas (LNG) provided more than 80% of the supply of natural gas to the countries of the European Union (EU-27) and the United Kingdom (UK) in 2020, up from 65% a decade earlier. And Russia is by far the largest supplier.

According to BEIS, some 42% of the UK’s primary energy consumption was derived from natural gas in 2020, up from 24% in 1990. And although wind, for example, is growing fast it only provides 4% of our primary energy supply.

North Sea back in fashion

Interestingly, the crisis has completely changed the conversation around natural gas, which has lower emissions than coal and oil. Sen. John Kerry, the US Climate Envoy, said it was a “bridge fuel”. The EU has categorised it, along with nuclear, as a sustainable fuel in its taxonomy. And the British Government has reiterated its support for the North Sea (while continuing to resist fracking).

None of this is to negate the multi-decade move to more renewables in order to reduce emissions and to tackle man-made climate change. But it does bring into question the policy framework around Net Zero. Britain is one of only 11 countries to put this into law, via secondary legislation without a vote in Parliament, in 2018.

The underlying flaw in the Net Zero policy framework is that it treats all fossil fuels the same. Whereas the best low carbon trade is to withdraw them in sequence: first coal, then oil, then gas, as renewables and low carbon sources like hydrogen and nuclear come on stream.

Faulty framework

This is the flaw in the legal recommendations of the Climate Change Committee and the consequent investment drought in natural gas orchestrated by Mark Carney, Michael Bloomberg and others via the climate stress tests on banks by the Bank of England, the Taskforce on Climate-Related Financial Disclosure and the Glasgow Financial Alliance for Net Zero. Raising capital for investment in natural gas in the City is almost impossible.

The perverse consequences of these measures has been actually to suck coal back into the market, even in the UK, because it is the cheapest fuel. The result will be record carbon emissions and fossil fuel consumption this year. The energy majors are also reporting the highest profits in eight years. So-called “dark capital” from unconventional sources is being made available. And “Environmental, Social and Governance” strategies are suddenly not so fashionable. That is quite a score card for COP26.

The lesson is we need to invest sufficiently in hydrocarbons during the transition to net zero and to defend that is a common sense, responsible thing to do.

Unpicking this mess, while maintaining a commitment to a low carbon economy, will help bring inflation down. But it is going to take some clever footwork by politicians and regulators in the UK and the EU.

Still, at least there is no fighting in the Ukraine.

George Trefgarne is CEO and founder of Boscobel, an independent strategic communications firm providing clients with bespoke financial PR & public affairs advice.