This question – could Rome have had an industrial revolution? – is prompted by Kingdom of the Wicked, a new book by Helen Dale. Dale forces us to consider Jesus as a religious extremist in a Roman world not unlike our own. The novel throws new light on our own attitudes to terrorism, globalization, torture, and the clash of cultures. It is highly recommended.

Indirectly, however, Dale also addresses the possibility of sustained economic growth in the ancient world. The novel is set in a 1st century Roman empire during the governorship of Pontus Pilate and the reign of Tiberius. But in this alternative history, the Mediterranean world has experienced a series of technical innovations following the survival of Archimedes at the siege of Syracuse, which have led to rapid economic growth. As Dale explains in the book’s excellent afterword (published separately here), if Rome had experienced an industrial revolution, it would likely have differed from the actual one; and she briefly plots a path to Roman industrialization. All of this is highly stimulating and has prompted me to speculate further about whether Rome could have experienced modern economic growth and if Dale’s proposed path towards a Roman Industrial Revolution is plausible.

Roman Economic Prosperity

For decades, historians were deeply skeptical of the potential of the ancient world to generate sustained economic growth. Influenced by Moses Finlay and Karl Polanyi, historians saw the ancient and modern worlds as separated by a cultural and economic chasm. Prior to the Industrial Revolution-era leaping of this chasm, individuals supposedly lacked “economic rationality,” did not seek opportunities to maximize profit, and were disinclined to use new technology for economic purposes.

This view is no longer credible. In his recent book, The Fate of Rome, Kyle Harper depicts a Roman economy which supported both population growth and rising per capita incomes. It was an economy in which inequality was high— the rich were super rich — but even the middling classes or urban poor had access to a wide range of premodern “consumer goods”. Moreover, according to Harper, this was based on market-orientated Smithian growth:

“Peace, law, and transportation infrastructure fostered the capillary penetration of markets everywhere. The clearing of piracy from the Mediterranean in the late Republic may have been the single most critical precondition for the burst of commercial expansion that the Romans witnessed; risk of harm has often been the costliest impediment to seaborne exchange. The umbrella of Roman law further reduced transaction costs. The dependable enforcement of property rights and a shared currency regime encouraged entrepreneurs and merchants . . . Roman banks and networks of commercial credit offered levels of financial intermediation not attained again until the most progressive corners of the seventeenth-eighteenth century global economy. Credit is the lubricant of commerce, and in the Roman empire the gears of trade whirred” (Harper, 2017, p 37).

This assessment is bold but consistent with the recent findings of archaeologists who continue to uncover evidence of dense trading networks and widespread ownership of industrially produced consumption goods across the empire. Willem Jongman’s chapter in the recent Cambridge History of Capitalism summarizes many of these new findings:

“crucial performance indicators show dramatic aggregate and per capita increases in production and consumption from the 3rd century BCE, or sometimes a bit later, until the Roman economy reached a spectacular peak during the 1st century BCE and the 1st century CE, lasting until perhaps the middle of the 2nd century CE” (Jongman, 2015, 81).

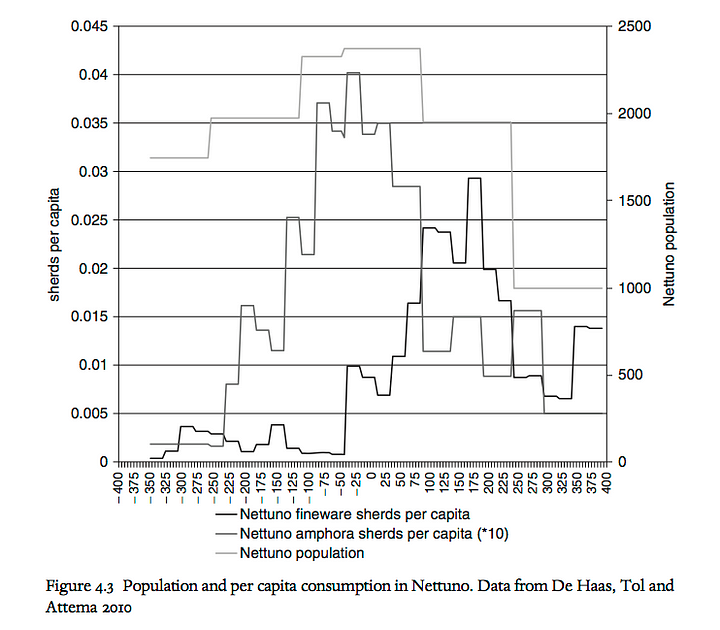

Jongman’s chapter provides evidence of intensified coal production, pollution, building construction, and animal consumption. I’ve reproduced one of his figures. It depicts the rapid increase in pottery shards from Netturo (approximately 50 km south of Rome) in these centuries.

From this wealth of evidence, we know that the classical world experienced what Jack Goldstone has called a “growth efflorescence”.

But at even the Roman empire at its peak in the reign of Marcus Aurelius does not appear to have been on the verge of modern economic growth. Rome lacked some of the crucial characteristics of Britain on the eve of the Industrial Revolution. There was no culture of invention and discovery, no large population of skilled tinkerers or machine builders, and no evidence of labor scarcity that might have driven the invention of labor-saving inventions.

The Roman Counter-Factual

Before concluding that a Roman Industrial Revolution was impossible, however, perhaps some caution is required. In many respects the British Industrial Revolution was overdetermined. Nick Crafts made this point eloquently almost 40 years ago in his comparison of Britain and France:

“there are no “covering laws” which explain England’s primacy; the best we can do is to formulate explanatory generalizations with an error term. Given that the “event” is unique, the tools of statistical inference are inadequate to explain the timing of decisive innovations . . . Furthermore, if the Industrial Revolution is thought of as the result of a stochastic process, the question, “Why was England first?” is misconceived: the observed result need not imply the superiority of antecedent conditions in England” (Crafts, 1978).

Craft’s point is that the timing of Industrial Revolution was partly random and, in the absence of repeated experiments, we will never have precise causal estimates of the impact of any single factor that distinguished 18th century England, from France, Qing China, or indeed ancient Rome. All that we can say is that the balance of probabilities was such so as to make an economic breakthrough much more likely in 18th century Europe than in China or the ancient world.

Likely is not certain, however. And unlikely is not impossible or inconceivable. At the very least, the new archeological evidence should prompt us to upgrade our assessments of ancient ingenuity and prosperity. So perhaps a Roman Industrial Revolution was not inconceivable? If we accept this, Dale provides an intriguing alternative path for Roman economic development.

Historians have long argued that the ubiquity of the chattel slavery was an insurmountable barrier to the adoption of labor-saving technology. In response to this argument, Dale locates her Roman Industrial Revolution in the early and mid-2nd century BCE, before the large-scale influx of slaves from the conquests of Greece, Carthage, and Gaul. The Middle Republic provides a window in which, she argues, it is plausible to imagine a machine-based culture taking root. In the world Dale envisions, an industrialized Roman empire then follows a British-style path towards a constitutional monarchy (under Augustus).

The technological development path, she describes, sees the Romans push ahead in medicine and biology. In this scenario, Rome benefits from a technology trajectory that takes place in the absence of Christianity with its prohibition on dissecting human bodies. A point of tension in the novel is the Roman occupier’s sanguine building of an abortion clinic in Jerusalem, simply because this is what Romans have at home; they do not — and did not — consider abortion wrong. Here I want to ask: What do these reflections tell us about the possibilities of economic growth in the premodern world?

Three Different Views About the Origins of Modern Economic Growth

Consider some prominent views about what caused the British Industrial Revolution. At the risk of grossly simplifying matters we can put them into three bins.

First, there those who tend to think that market expansion is sufficient for sustained economic growth. Call them group 1. They will be inclined to favorably quote Adam Smith from his lectures on jurisprudence that “Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism, but peace, easy taxes, and a tolerable administration of justice”. Many libertarian-learning economists are in this category but few active economic historians.

Second, there are those who argue that colonial empires or natural resources like coal were crucial for modern economic growth. Call them group 2. This view is associated with the “world systems” theory of Immanuel Wallerstein. Perhaps the most sophisticated exponent is Ken Pomeranz in the Great Divergence (2000). Pop versions are common among many historians and sociologists but this position has little support among economic historians.

Third, there are those who argue that ultimately only innovation can explain the transition to modern economic growth. This is the position of the majority of economic historians. Label them group 3. However, this third group is divided between those who seek to explain the increase in innovation in purely economic terms (3a) and those who see this as an impossible task and argue that the answer has to be sought elsewhere, perhaps in something that can be broadly defined as culture (3b).

The idea that simple economics could explain why innovators developed labor-saving machinery like the spinning jenny in 18th century England (but not in France or India) is advanced by Bob Allen. It is perhaps the dominant view in economic history at the moment. But it has come under criticism recently as the evidence for a high-wage economy in 18th century England appears weaker than was previously supposed (see the work of Judy Stephenson (here) and (here)).

Two prominent alternative versions of 3b are associated with Deirdre McCloskey and Joel Mokyr. McCloskey and Mokyr advance distinct arguments, but both would agree that the inventive and enterprising spirit that characterized 18th century England cannot be explained in terms of simple incentives. They instead argue that it required recognition of “Bourgeois Dignity” or a “Culture of Growth”.

Mapping Modern Views to the Roman Counter-Factual

Adherents of the first position, the view that trade, commerce, and market development were a sufficient condition for modern economic growth should find the Roman Industrial Revolution counterfactual highly appealing. As Harper notes: “The empire by its nature systematically leveled barriers to trade” (Harper 2017, 37). Importantly, Rome had a legal system that venerated property rights and was designed to facilitate impersonal trade (see here). Indeed, the startlingly “modern” characteristics of the Roman legal system, including property rights for married women, feature prominently in The Kingdom of the Wicked. This legal system also provided stability for economic exchange and a framework through which impersonal trade and business organizations could emerge. Though the imperial period saw the emperors acquire broad-ranging autocratic authority, from an economic perspective, Roman citizens enjoyed something approximating what we would recognize as rule of law.

Similarly, members of group 2 should recognize that the Roman empire was a coherent, capitalist, “world system”. Rome had its colonies; the core had a periphery to exploit. Recent archaeological evidence, for instance, suggests that the Roman economy was much more closely integrated with the Indian Ocean trade than we previously thought. The Roman “world” system was based around the Mediterranean economy rather than the Atlantic world, but there seems little intrinsic reason why it should have been less successful than the early modern world system in generating economic growth.

Advocates of the third position are likely to be more skeptical of a Roman Industrial Revolution. Nonetheless, those persuaded by Bob Allen’s high wage theory of the British Industrial Revolution should be at least intrigued by Dale’s alternative Roman history. Had wages been high and energy, and capital relatively cheap, would the Romans have put their engineering mindsets to the invention of steam engines and the equivalent of the spinning jenny? If factor prices were crucial to British industrialization, then could there have been a Roman industrial revolution under similar conditions?

We have no way of answering this question. But Dale is probably right to argue that any such break-though would have to have come in the 2nd century BCE, a period of rapid economic change, urbanization, and commercialization. The smallholder farmers of Italy were replaced by large-scale commercial farming (latifundia). Losing their land, these displaced peasant farmers became soldiers or joined the urban poor in Rome itself. To replace them, landowners imported huge quantities of slaves. One prominent view among historians (the “Beloch-Brunt” model) holds that the free population of Italy fell from around 4.5 million in 225 BCE to 4 million in 28 BCE (see Morley (2001) for a discussion). Regardless of whether this is right, there is no doubt that the demand for slaves soared after 200 BCE, and that their ready supply encouraged landlords to practice commercial agriculture on a vast scale. Such an economy was ill-suited for modern economic growth. But the point is that in a counterfactual world where such a supply of slave labor was unavailable, on the Allen model, it is possible to envision Rome experiencing an industrial revolution.

On the other hand, the arguments of McCloskey and Mokyr suggest greater skepticism towards the counterfactual we have outlined. Mokyr argues that made 18th century Britain distinctive was a “culture of growth” (see my review here). The more one buys into Mokyr’s emphasis on the importance of a competitive Republic of Science, the less likely is it that the Roman empire would have offered a conducive environment for science and innovation. Perhaps had the Roman Republic failed in its quest for supremacy in the Mediterranean, things might have gone differently?

Similarly, I am not aware of evidence of the kind of rhetorical change in attitudes towards commerce in the Rome world that McCloskey documents in the 17th century Dutch Republic or 18th century England — no new-found respect for traders and merchants, over and above soldiers and adventurers, and no evidence of lessening distain for commerce or business. If these cultural attitudes were the binding constraint in late medieval and early modern Europe, then they were equally binding in antiquity. I’ve speculated in an earlier post on the ways in which slavery and other Roman institutions reinforced a cultural ethos that was hostile to trade-based economic betterment (here). But I would be eager to read counter evidence. Perhaps specialists do know of evidence of a change in Roman attitudes to commerce during this period?

All of this suggests that a better understanding of why sustained or modern economic growth did not occur during earlier “efflorescences” can help us better understand which factors were important in the explaining the transition that did take place after 1800.